Buying behaviour in the real estate market changed in the first quarter of 2023. Buyers are no longer interested in buying for immediate appreciation of the new building but are looking for a product that best suits their needs at a reasonable price. First quarter of 2023 saw not a single sale in up to one third of residential projects, with demand at its lowest figures for the last 15 years. Apartment prices in new buildings are stagnating for the second consecutive quarter.

This year’s first quarter failed to reiterate the optimism from January’s high demands, with nearly a third of bookings dropped during this period. As many as 75% of the sold apartment pertained to 15% of the total registered number of 93 development projects.

“A strong January may have been understood as people still being motivated to take advantage of the existing conditions for housing finance to buy a new home, but the subsequent two months did not confirm the trend. As many as one third of development projects failed to record a single sale in the first quarter, with otherwise twice as many such projects sold on a monthly basis,” explains Filip Žoldák from the Herrys real estate agency, which analysed the market in new apartments in Bratislava for the first quarter of 2023.

What is the supply in the apartment market in new buildings?

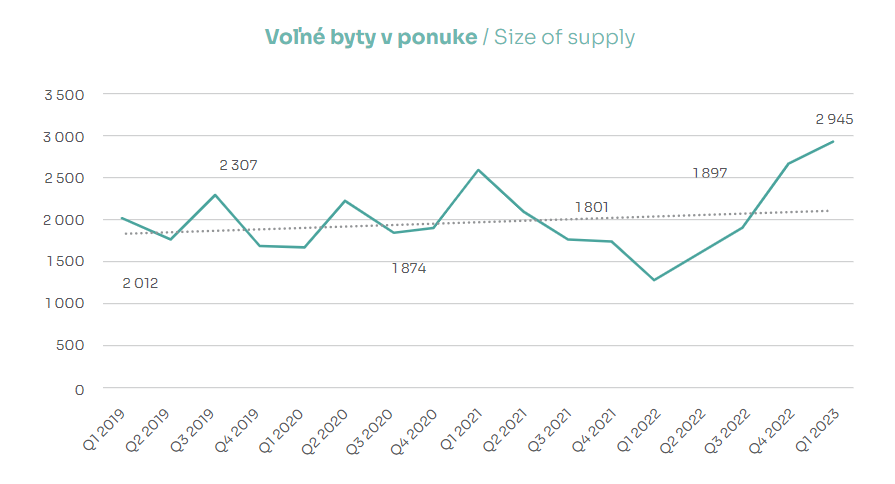

The supply of new apartments has been growing steadily for 12 months and has now reached more than 2 900 vacant apartments, the highest figure since the 2008-2010 crisis. However, this was not caused by a larger-than-normal increase, but by a significant slowdown in demand. The largest supply of apartments was recorded in the Bratislava’s second district, with almost a thousand apartments for sale.

Developers are offering the well-performing two- and three-bedroom apartments in particular, which have long accounted for almost 70% of the supply, with two-bedroom apartments (45%) predominating and seeing a year-on-year increase of 3 percentage points (Q1 2022 – 42%), and three-bedroom apartments (24.5%) decreasing in numbers year-on-year (Q1 2022 – 29%).

“The clear dominance of two- and three-bedroom apartments suggests that a year ago investors prevailed among buyers, while today it is mostly buyers looking for their own housing,” adds Filip Žoldák.

Lowest demand in 15 years and stagnating prices

Demand in the first quarter of 2023 has been the lowest in the past 15 years, down by an average of two-thirds year-on-year; the smallest change in demand was recorded in the BA I district, where demand is half of last year’s level. The highest number of apartments was sold in Bratislava’s second district (Ružinov, Podunajské Biskupice, Vrakuňa) and the lowest sales were made in the projects in Bratislava’s fifth district (Petržalka).

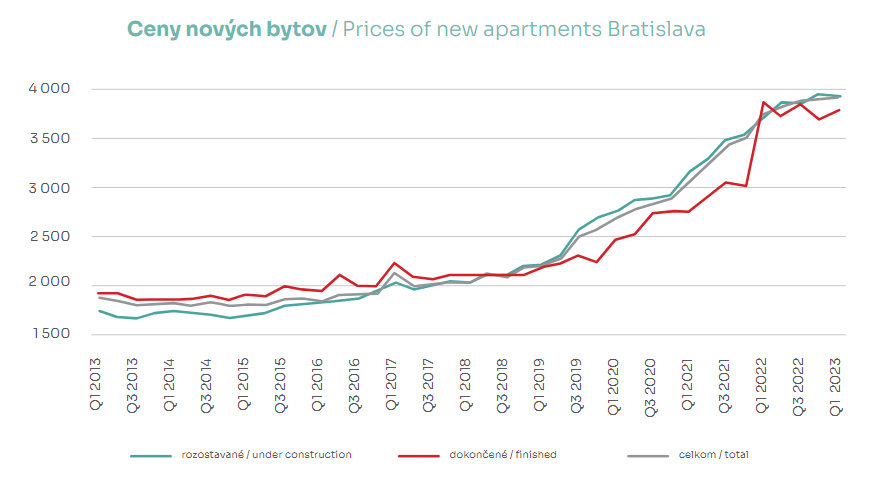

Apartment prices in new buildings have been stagnating for the second consecutive quarter. The average price per m2 is €3 889 excl. VAT, i.e. almost unchanged against the previous quarter. Compared to last year, it has increased by 200 €/m2.

However, not all projects have been equally affected by the reduced demand and the key to success appears to be the readiness of the product in terms of modelling the apartment layouts and floor sizes to the target groups.

“The current pace of sales motivates developers to adjust their sales strategy, but not the price, mainly due to a relatively high sell-out rate of their projects. Thus, we can observe mainly three approaches they choose: either do nothing, because from their point of view it makes no sense to embark on a product or price change at a time when demand is minimal. Or they choose a product change strategy, which may involve standard equipment, a kitchen worktop with appliances, a parking space included in the apartment price, making financing available in the form of a lease with a delayed mortgage or other tools that mean a discount for the buyer. The third strategy is to delay the sale or construction of the project, but this applies mainly to those projects in the early stages, though we are seeing this approach taken by multiple developers,” says Filip Žoldák.