The long-term declining supply is failing to satisfy demand for residential real estate, despite constantly rising prices. HERRYS real estate agency data shows that apartments sold exceeded by a third the number of apartments coming on offer and compared to the same period a year earlier supply halved. Despite the rising prices motivating buyers to buy properties “here and now”, the market showed noticeable hesitation among buyers in the first weeks following the outbreak of war in Ukraine. Currently, the average price in Bratislava stands at 3 699 €/m2.

The first quarter of 2022 was marked by a number of factors affecting the mood in the real estate market. The ongoing pandemic and the war in Ukraine led buyers to hesitate, yet after only a few weeks the situation returned to the pre-crisis conditions, as shown by HERRYS data based on real transactions. Real estate prices are still rising, the average price in Bratislava was 3 699 €/m2, this being reflected, too, in the complete sale of more expensive apartments. In the first three months, apartment sales exceeded supply by a third.

“Low supply of apartments is one of the main reasons for rising prices. Combined with inflation, it motivates buyers towards buying an apartment as soon as possible, since prices are rising on a monthly basis. Despite the National Bank of Slovakia’s talk that the number of projects under construction is the highest of recent years, it must nevertheless be added that most of these projects are already contracted by future buyers and more apartments are still being sold than coming on offer,” said Filip Žoldák from HERRYS.

Supply has seen long-term decline, with the 487 apartments coming on the market in first three months of 2022 representing just half of the figure from the first quarter of 2021. The low supply is due in part to the fact that several developers have suspended sales in individual projects, as they have sold a sufficient number of apartments already. This is another reason why we shouldn’t expect to see any fall in new-build apartment prices, since in combination with the unclear development of building materials prices, developers are not under any pressure to sell apartments as quickly as possible. According to current data, the sold-out rate in projects is as much as 75%, with fewer than 3 apartments being sold on average per month per project.

The rate of sales still exceeds growth in supply

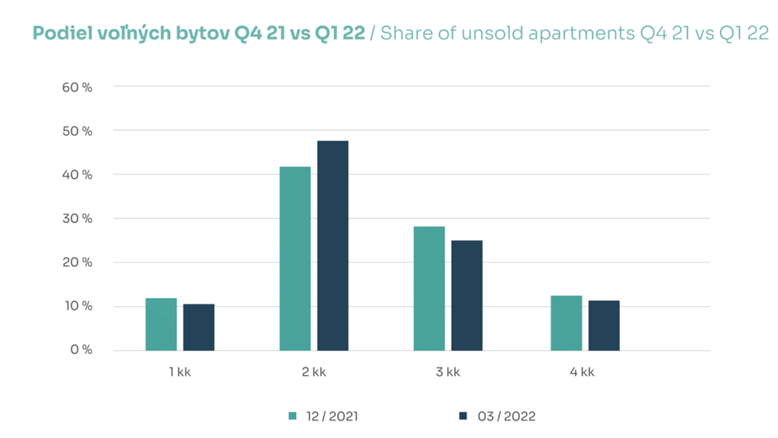

The first quarter of 2022 saw a total of 650 apartments sold. Most of them were in the still popular district Bratislava II. Although apartment sales fell by 14% against the year earlier, in real terms it exceeds the number of apartments that came on offer, by 34%. This means that more apartments were sold than were added to the market. At the same time, the HERRYS Agency registers 1 337 unsold apartments in 66 projects, of which only 36 apartments are in projects already completed. Unsold apartments fall most in the category 2kk (2 rooms + kitchen corner), representing 42% of the total supply, and the category 3kk, representing 29% of the current market offer.

The pace at which prices rose in the last quarter accelerated by 2.3% and year-on-year growth reached 14.6%. HERRYS experts view the sale of new-build completed apartments at a unit price per m2 at higher prices than those under construction as a positive trend; on average, the difference is 6.5% of the price. The reason is in particular that the finished apartment available immediately should naturally be more expensive than the apartment under construction.

Prices will grow, no need to hesitate with buying

Under these circumstances, it is very difficult to predict the further development of the real estate market, due to the high number of variables. It remains true that supply will continue to decline, especially due to the poor preparation of new development projects caused by disproportionately lengthy processes at authorities granting permits. Nonetheless, real estate prices will not fall; on the contrary, a further increase can be expected.

“We understand that people are hesitant to buy with real estate property prices rising, but we see no reason why the rise in prices should cease,” added Filip Žoldák from HERRYS. Development trends will also be influenced in part by banks, as they have already increased or announced interest rate rises, which is why experts do not recommend waiting to buy an apartment. The more people delay buying, the more apartment prices will rise. Sellers hold all the winning cards, because they are not in the situation where they would be forced to sell apartments in projects as a matter of urgency. In view of the rising input costs for construction, we can assume that many projects will be sold only after their completion.

Given the rising prices, the media are increasingly returning to the issue of the real estate bubble and the possibility of it bursting. Experts from HERRYS, though, note that the price growth is catching up with the growth in costs and high demand, as other conservative investment assets are far from achieving such a return, i.e. investing in real estate remains the best choice.