A large year-on-year drop in demand, though compared to the second quarter of this year the number of apartments sold decreased in line with the standard curve – this is a brief description of the third quarter on the market in new residential projects in Bratislava. What has barely changed, though, between these quarters is the price. On average, this remains at 3 868 €/m2 excl. VAT, i.e. an increase of 13% compared to last summer, but only a 1.7% increase against the second quarter. HERRYS real estate agency experts talk of prices having hit a local ceiling; prices may remain at this limit for some time.

This past summer, the forecast of decreasing demand came true, and the number of apartments sold in the third quarter did not exceed the previous figures. Even though the decrease in the number of apartments sold in new buildings is normal between quarters, HERRYS agency has recorded a 40% drop against the summer of 2021. This is a consequence of rising real estate prices, growing interest rates, inflation, NBS restrictions, and uncertainty due to energy price rises. Despite these factors, sales have not fully halted. The number of people interested in buying new housing was, of course, weaker at the start of summer, but at its close the number was once again growing.

Between the quarters, the average price has hardly changed, rising only 1.7% and remaining at 3 868 €/m2 excl. VAT; the y/y price increase was 13%. The average price encompasses lower prices in projects still at the beginning of sales, balancing out higher prices in projects under construction and projects with more than half of apartments sold.

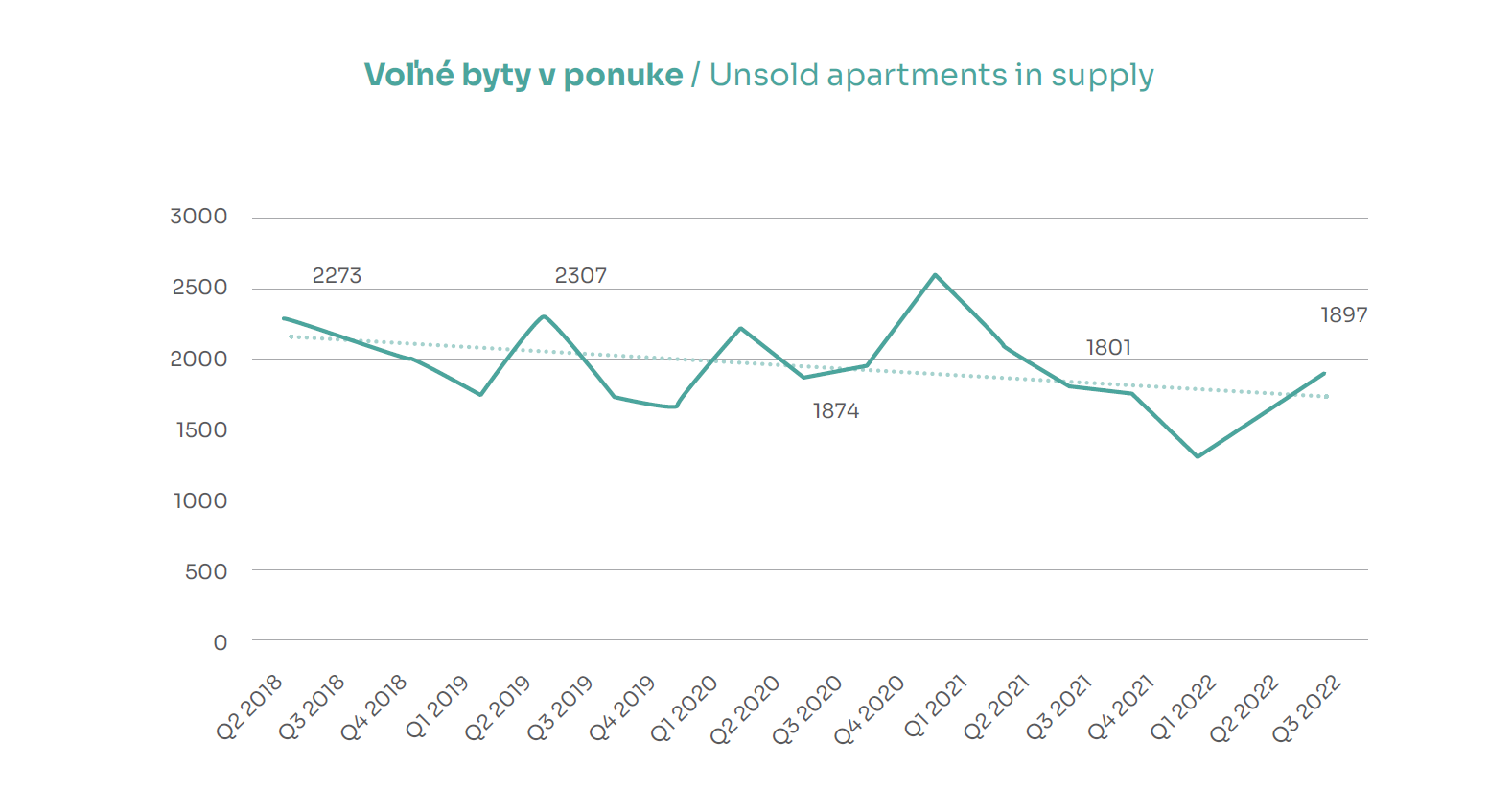

Apartments offered are sufficient for 1.5 years

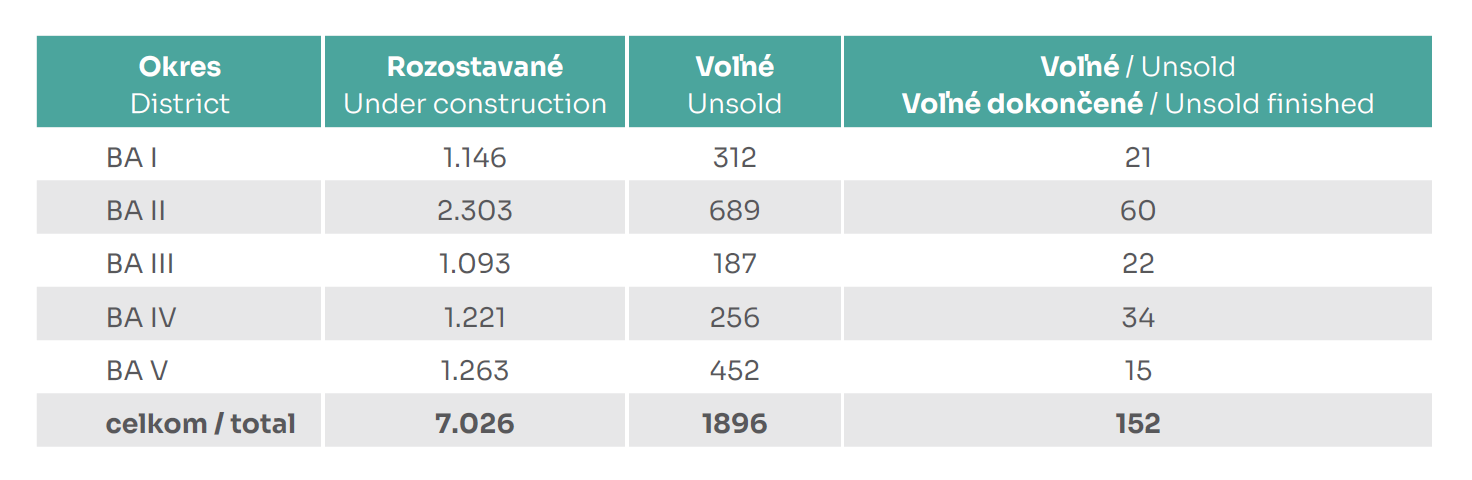

In total, there are almost 1 900 vacant apartments in development projects on offer; in the summer, the offer grew by approximately 400 new apartments, meaning 30% of all newly built apartments. Even though supply has been growing for the second quarter in a row, this is due more to the decreasing demand and longer period that apartments are remaining on offer. Given the current demand, the supply of apartments is sufficient for the next 1.5 years.

The widest range of apartments is in the Bratislava II district, which is also home to the most projects under construction. The Bratislava V district has the fewest projects, with only six projects on offer. Almost 70% of the offer consists of 2-room and 3-room apartments, 1-room and 4-room apartments are equally represented at 12%. Sold apartments copy this trend, with most sales being in 2-room and 3-room apartments; the interest in 4-room apartments is greater than that in 1-room apartments. Of the two categories, the most sold were in Ružinov.

Inflation clauses as a key topic

A big topic over the recent months has been inflation clauses, which have the potential to scare off buyers. These have recently been introduced into contracts by a number of developers, with the aim of reflecting increased construction costs into the apartment prices. The inclusion of an inflation clause in the purchase contract does not immediately mean that the developer will exercise it. On the contrary, some developers have decided to bear the burden of growing costs and not to pass them on to the buyer, an example of which is the Metropolis project in the Bratislava downtown.

Investment in housing is still worthwhile; prices can remain at their present level

According to experts from HERRYS real estate agency, prices have hit their local ceiling (local maximum), and so they comment that prices are stagnant. They view the minimal increase more as a statistical issue. They believe that the potential for further growth will be revealed only by how demand develops over the coming period. The real estate market is, though, driven by economic influences that can keep prices at their present level, where these are in particular the high and ever-increasing construction costs, but also the sold-out rate of projects, low supply, and last but not least, inflation.