The second quarter of 2025 marked a significant revival in Bratislava’s new residential project market. The supply of available apartments climbed to its highest level in the past 15 years, while buyer demand increased – particularly for properties still under construction. The average price of available units rose, mainly due to the remaining inventory consisting of more expensive apartments.

Record Supply: Over 3,300 Apartments on the Market

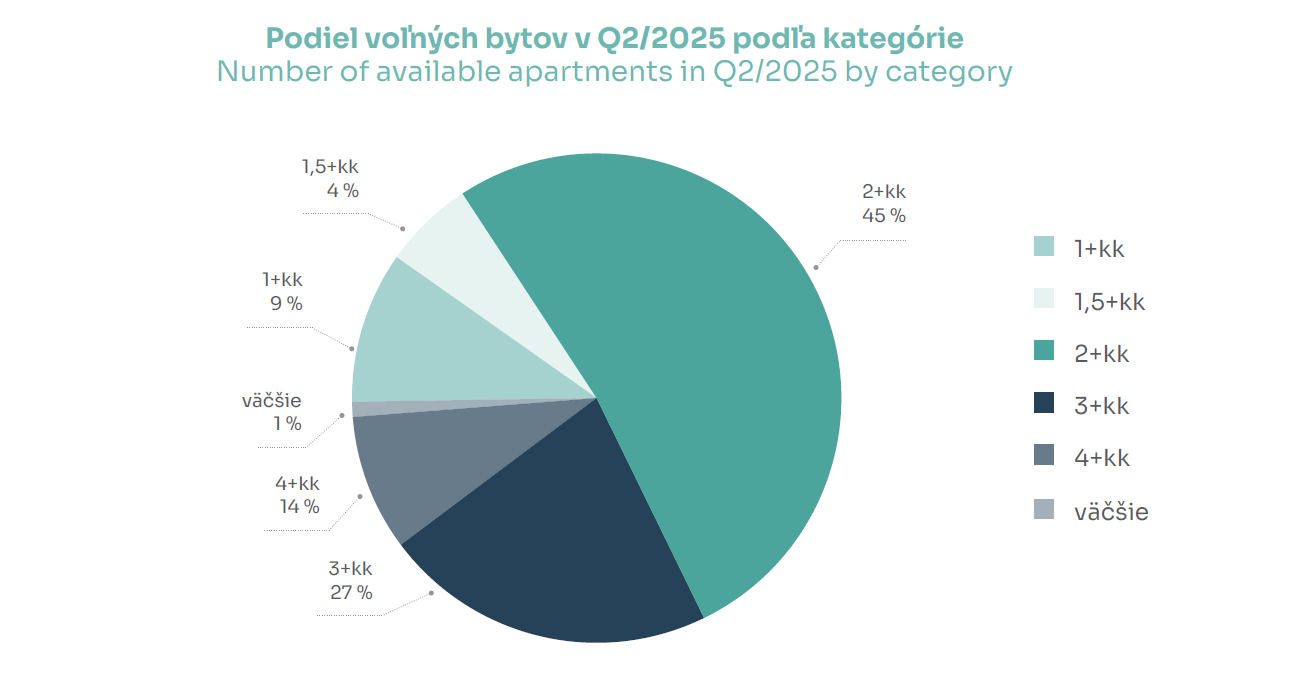

At the end of Q2 2025, there were a total of 3,345 available apartments on the market – the highest number recorded in the past 15 years, continuing the upward trend that began in Q1 2022. The composition of the supply has remained largely unchanged, with 2-bedroom (2+kk) units consistently representing the largest share. The most significant increase in availability was seen in Bratislava IV, where the number of available units rose by more than 40% quarter-over-quarter.

The lowest supply was recorded in Bratislava V, while Bratislava III also saw a decline. The proportion of completed units in the total supply has remained stable at around 25% for over a year.

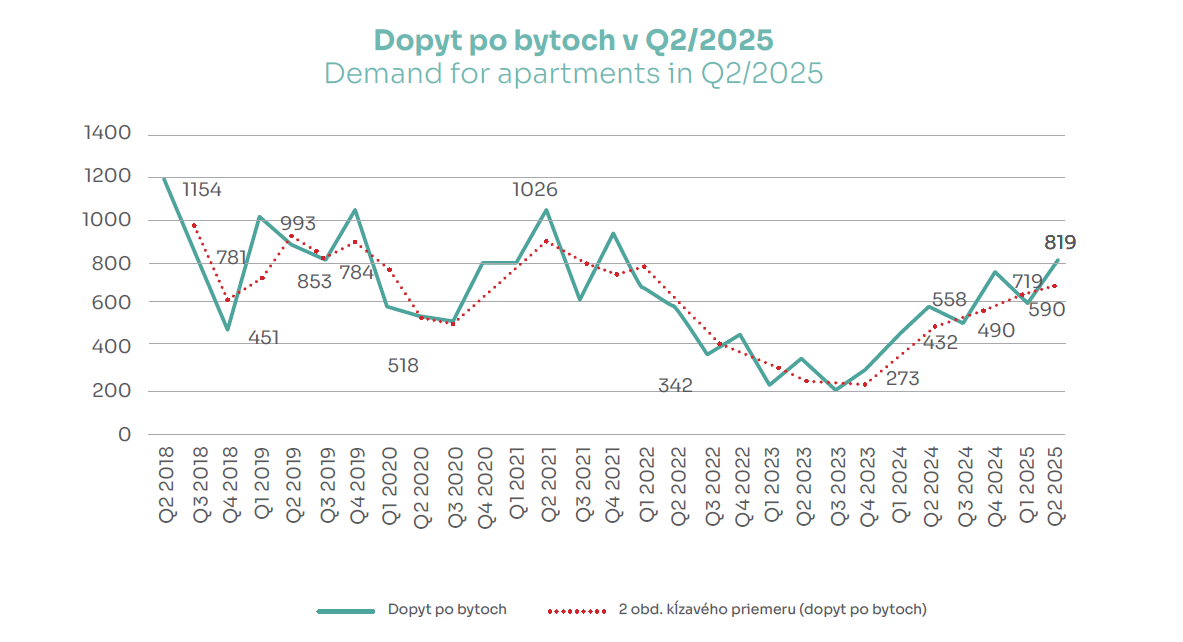

Demand Strengthens as Bratislava IV Surpasses Traditionally Dominant Bratislava II

A total of 819 apartments were sold during the quarter. Bratislava IV recorded the highest number of sales, surpassing the traditionally strongest district, Bratislava II.

A key driver of sales in this area were new phases of the Čerešne and Bory bývanie projects, which together accounted for 62% of all apartments sold in Bratislava IV, making them the primary engines of demand in the district.

2-bedroom apartments (2+kk) made up 52% of sales, signaling a notable shift in buyer preference – particularly at the expense of smaller 1- and 1.5-room units.

There was also increased interest in 4-room apartments, especially in completed projects and in peripheral parts of the city.

The share of sold apartments in completed projects is declining, suggesting growing interest in under-construction or even pre-construction homes.

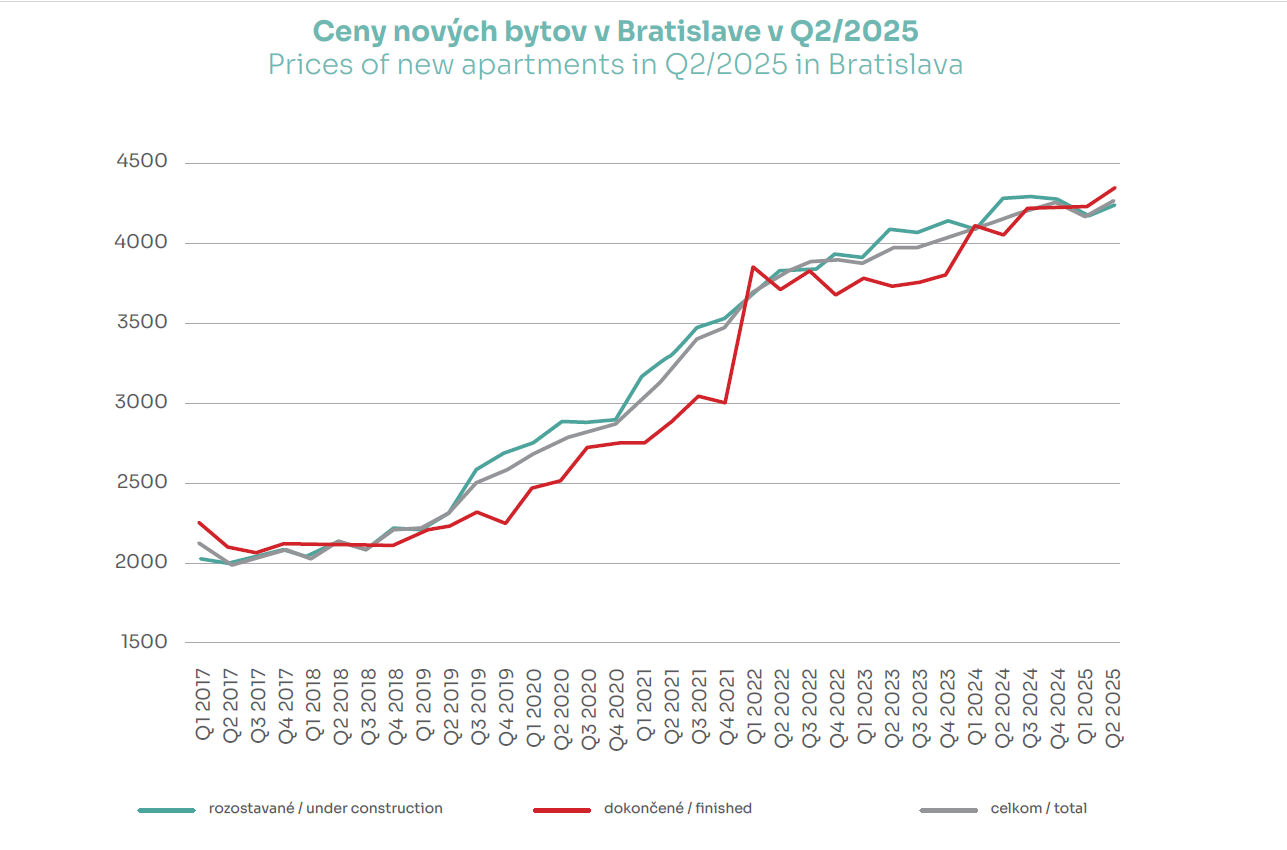

Prices Increase – Most Notably in Bratislava IV

The overall rise in average apartment prices was driven by price increases in both available and completed units. The average price in development projects reached €4,264 per m² excluding VAT.

The most notable price growth occurred in Bratislava IV, due to the sell-out of more affordable pre-sale units, leaving only more expensive apartments in the current offering.

In Q2 2025, the gap between asking prices and transaction prices narrowed, reflecting strong sales of 2-bedroom units and increased transactions in Bratislava I (city center).

Buyers Favour Off-Plan Properties

The data clearly show a shift in buyer preferences. Sales of completed apartments have been declining for over 12 months, while interest in off-plan (pre-sale or under-construction) units continues to rise.

This trend is primarily driven by the more accessible pricing of such units and the possibility to defer a significant portion of financing until project completion – a factor appealing not only to households but also to investors.