• The supply of apartments in new projects has doubled year-on-year. Prices have stabilised, with new apartments now 12% more expensive than in 2021.

• Supply on the secondary market also doubled, but growth stalled in Q4. Prices have stabilised, even falling by 5% in the second half of the year but are still more expensive than in 2021.

• Supply in the rental market has halved and prices have risen by 35% due to increased demand and lower affordability of financing owner-occupied housing.

The turning point in the property market in 2022 was neither the war in Ukraine nor the energy crisis, but rather the increase in commercial banks’ interest rates. This slowed sales of apartments both on the primary (new) and secondary market. So, after years, renting housing is becoming more affordable again than paying off a mortgage. Nevertheless, expert analysis from HERRYS estate agency indicates that there will not be any sudden changes in the market. The stabilisation of prices and supply shows that sellers are not under pressure to sell, because it is advantageous to rent out an apartment.

The real estate market has been shaken by increased supply and tightened conditions for obtaining a mortgage, according to a regular quarterly market overview prepared by HERRYS estate agency. In addition to the increased supply in new-builds, which actually doubled compared to the beginning of 2022, the past year was marked also by continuous growth in the supply on the secondary market. Sales, though, slowed in both segments.

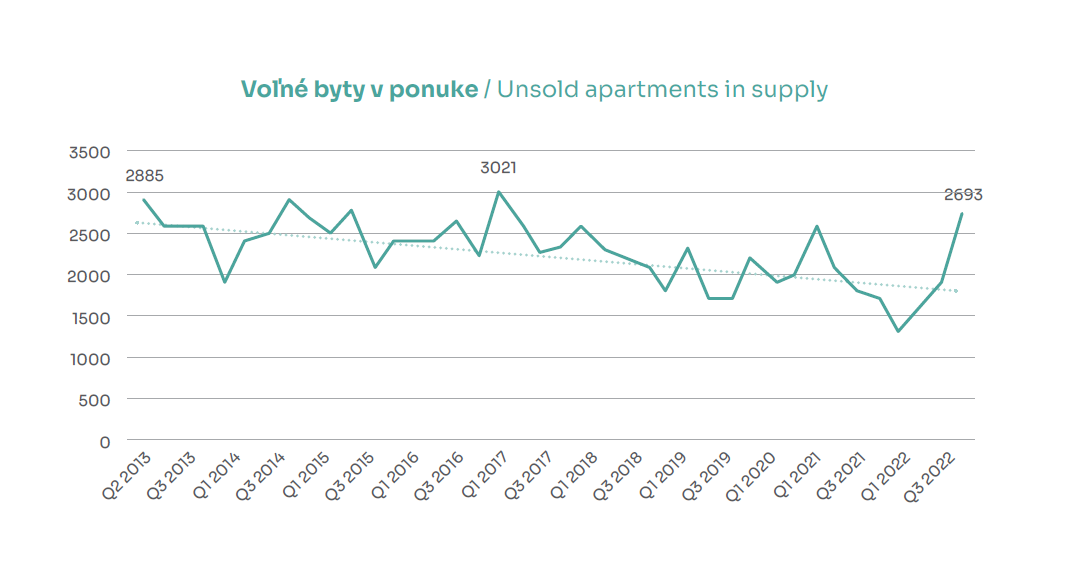

The supply of new-builds currently represents 2693 apartments in 88 development projects. At the current rate of sales, that is sufficient for 1.5 years. Those selling on the secondary market, on the other hand, must today expect to wait an average of 41 days to sell their apartment, as opposed to an average of 19 days a year ago. Two-bedroom flats dominate among sales of new apartments, accounting for 45% of the total supply, while three-bedroom apartments are the most popular on the secondary market.

Demand is limping, with prices impacted by interest rates

Demand from buyers currently does not reach the level of the summer or previous years. However, it increased by almost 25% quarter-on-quarter to the level of 427 sold apartments in new-builds. In total, 1992 apartments were sold last year, representing a year-on-year decrease of 40%. Interest focused on 46 projects, while some 19 projects did not record any sales at all for the second quarter in a row. Projects seeing the greatest interest were sold at a rate of 3 apartments per month, on average for all projects the rate of sales was 1.6 apartments per month. Up to half of the apartments sold in Bratislava were located in the third district BA III – Nové Mesto, Rača, Vajnory. For Petržalka it was again the weakest quarter in terms of apartment sales.

On the secondary market, prices rallied from the middle of the year, however, property prices year on year rose by 7.32% on average. The current average price is at the level of the turn of February and March 2022. Prices of new projects and new-builds are stagnating.

Drastically fewer apartments for rent

The current state of the real estate market favours the rental market. The offer on the rental market has fallen by 55% since March 2022. The supply of all categories of apartments decreased evenly, while rental prices increased by up to 35% on average. The offer decreased not only due to greater demand, but also due to the fewer apartments overall being added to the offer for rent. Whereas in the first half of the year there were an average of 2700 new offers each month, this figure fell to 1200 per month in the second half year. The rental market is dominated by two-room apartments, which form the largest share on offer (some 40%) and for which there is the greatest interest.

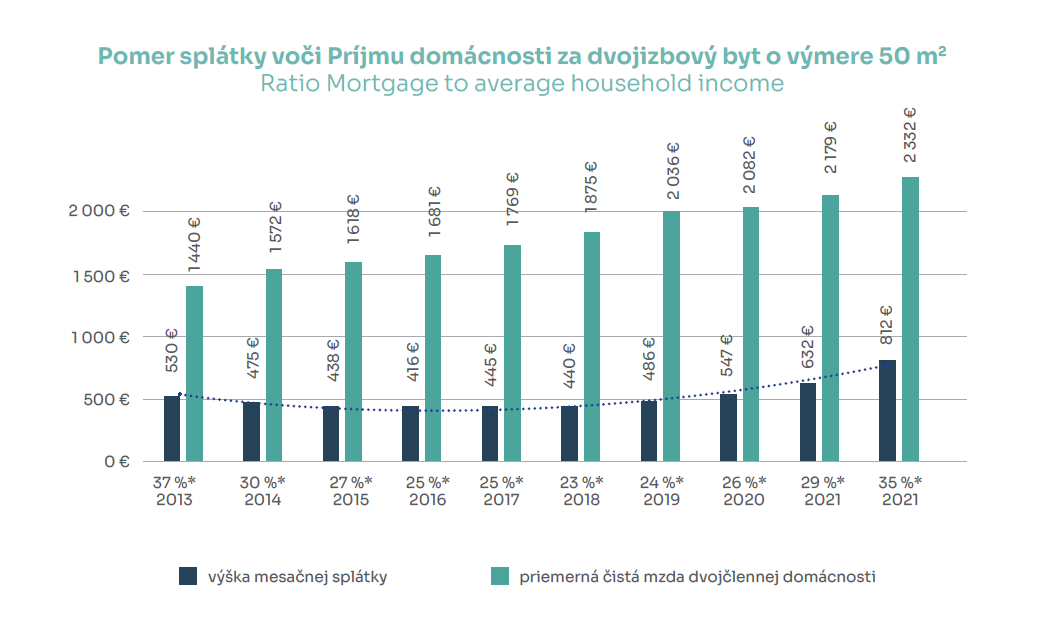

“The decrease in the supply of apartments for rent is the result not just of increased demand from war refugees, but also the overall reduced affordability of own housing. For a standard apartment with an area of 50 m2, this fell to the level of 2013,” explained Martin Marsina, partner at HERRYS estate agency. “Housing loan repayment on average forms 35% of net income for a household consisting of two people with an average net salary in Bratislava, excluding costs for energy and services. With the trend set in this way, increased demand can still be expected, and rents are expected to continue to rise in price until loan repayment and the rental amount are equal.”

* The quarterly report is prepared on the basis of publicly available third-party data which we are unable to guarantee and therefore cannot be held liable for any consequences that may arise as a result of this report. For the purposes of this report, price lists and publicly available listings for individual projects and specific apartments are used as a source, where, for the purposes of consolidation, we consider reserved apartments as sold, and we also record their increase and decrease. The supply of available apartments is counted only from apartments that are currently for sale and realistically available for purchase (some projects do not offer for sale all apartments that are under construction). The purpose of this report is not to describe in detail the actual situation, but to capture market trends and provide information on the development of the residential real estate market in the longer-term context.