Average prices in new builds in Bratislava increased by 18.5 % year-on-year, despite the decrease in the number of apartments sold, according to data from HERRYS estate agency. More than 680 apartments in new builds came on the market. Demand slowed slightly, with nearly 570 apartments sold. The average price of apartments in projects climbed to 3 802 €/m2.

Apartment prices increased by 18.5 % year-on-year, despite the fact that the number of apartments sold decreased by 13.5 % quarter-on-quarter. Supply is decreasing in the long term and there are around 500 fewer apartments on the market compared to last year, although according to data from HERRYS estate agency, they recorded a quarter-on-quarter increase in supply.

The key reason for the fall in supply is the lengthier process for obtaining permits for new projects, which are now coming on stream at an increasingly slower pace. Supply in the new-build market is thus more likely to be boosted by new phases of projects for which permits have already been obtained.

New projects are selling faster

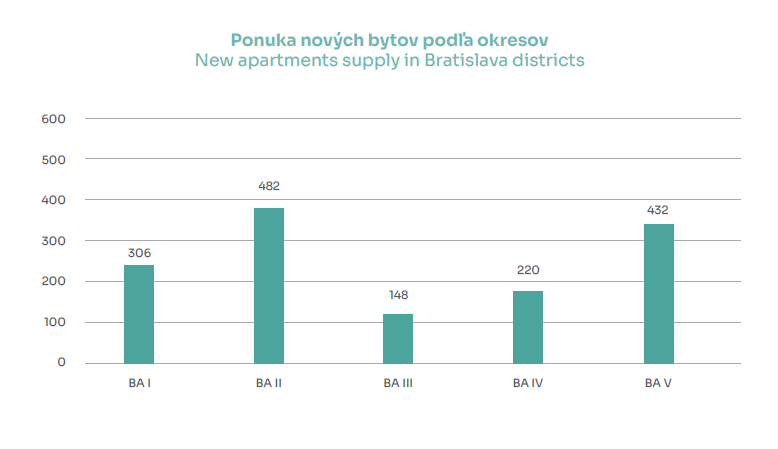

Whereas several projects suspended sales at the beginning of the year, sales were restarted in the second quarter. Some 7 new projects with 684 apartments came on offer, with a total of 68 projects being sold in Bratislava and supply at the end of the second quarter amounting to 1 588 apartments. Compared to the first quarter, supply increased by 251 apartments, though, when compared to last year, supply has actually fallen by 496 apartments. The largest number of apartments were added in the Bratislava II and Bratislava V districts, with up to 43 % of new apartments being two-room and 26 being three-room.

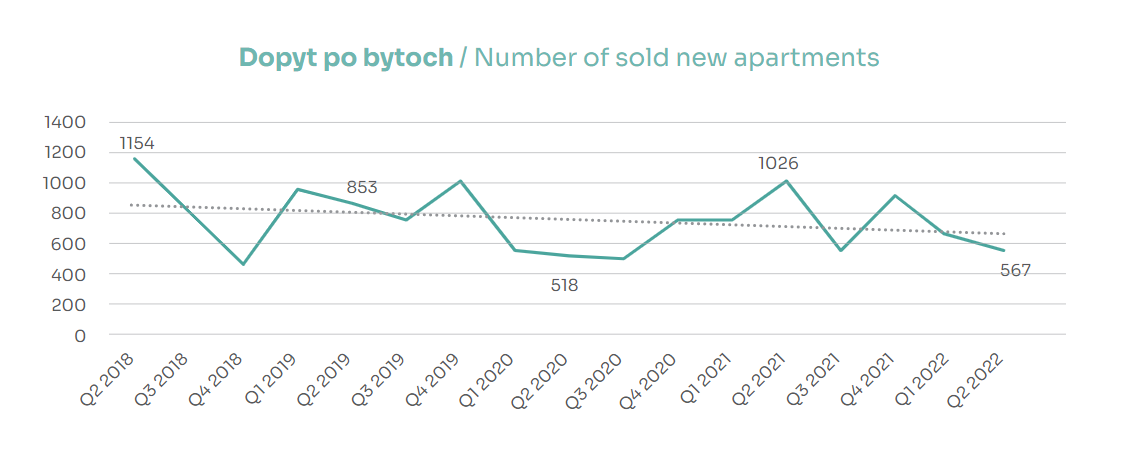

In the second quarter of the 2022, a total of 567 apartments in projects were sold, meaning an average of 2.78 apartments per project. Newly added projects the launched sales in the second quarter sold 31 % of the total number of units, three times the sales rate of older projects. While the first third of the project is selling out of the rate of 10 apartments per month per project, the last 15 % of apartments that remain are sold at a rate of 3 apartments per month per project.

The Bratislava II district, where the highest number of apartments was sold, still remains the most popular, but even so, a quarter-on-quarter drop in sales of up to 32.5 % was recorded. The Bratislava I district was the only district where sales increased by 10.9% compared to the first quarter. The average price of apartments in projects climbed to 3 802 €/m2 excl. VAT, while the highest average price being in the Bratislava I district, i.e. in the Old Town, where the average price is close to 5 698 €/m2 excl. VAT. The rest of Bratislava ranges at comparable average prices of 3 400 to 3 750 €/m2.

In terms of sales, the downward trend is set to continue

The speed and number of apartment sales are a reflection of the current level of apartment prices and increased interest rates. Nevertheless, demand is still strong enough to allow prices to rise or stagnate. However, the current and future absorption of residential supply will no longer be influenced by the housing market situation, but rather by inflation and the rising cost of living, which is eating away at household funds that could otherwise be invested.

Meanwhile, we are also seeing a slowdown in the secondary market, where supply is growing. Its growth, though, is not due to an increase in the number of new apartments on offer, but instead to the persistence of older apartments and, thus by a slowdown in sales. It is, nonetheless, not yet possible to say whether demand is actually decreasing, or whether the decision-making period of potential buyers is lengthening.