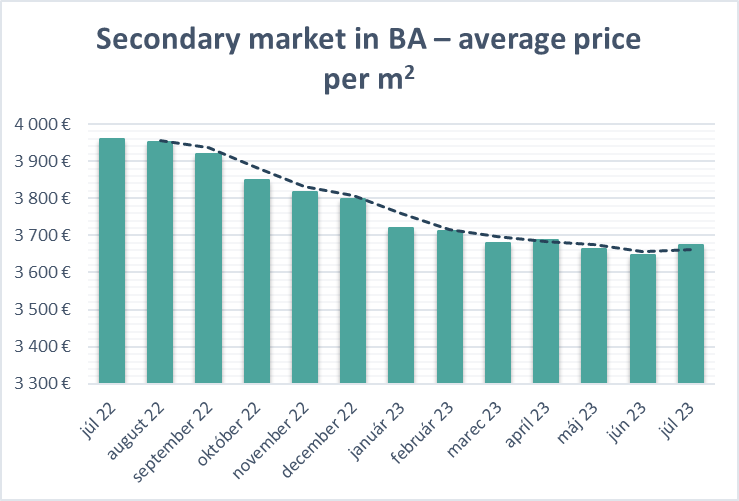

Both prices and offer of apartments on the Bratislava’s residential secondary market have been stagnant for 4 months. Nevertheless, the current market behaviour does not suggest any further significant price drops. The supply-demand ratio has reversed with more apartments having been sold over the past year than came on the market. Despite a slight increase in the overall average price per m2, there are districts that have also recorded a decrease in the average price per m2 both year-on-year and quarter-on-quarter. The results are based on the regular report of the real estate agency Herrys for Q2 2023.

Despite the stabilised property prices on the secondary market, Herrys real estate agency has recorded a slight month-on-month price growth in 4 Bratislava city districts in the period of June/July, in the BA 1 district this being by an average of 75 EUR/m2. The average price of apartments on the secondary market is 3 675 EUR/m2, with roughly 4 463 apartments on offer (data from July 2023). Apartment prices are currently at the same level as November 2021.

New-builds

The supply of new-builds currently comprises 2939 apartments in 90 development projects. For the first half of 2023, this represents an increase of around 650 apartments, i.e. only half to a third of the long-term average. This means approximately 33% of the total number of apartments under construction are available. The number of completed unsold apartments has more than doubled and accounts for almost 12% of the total offer.

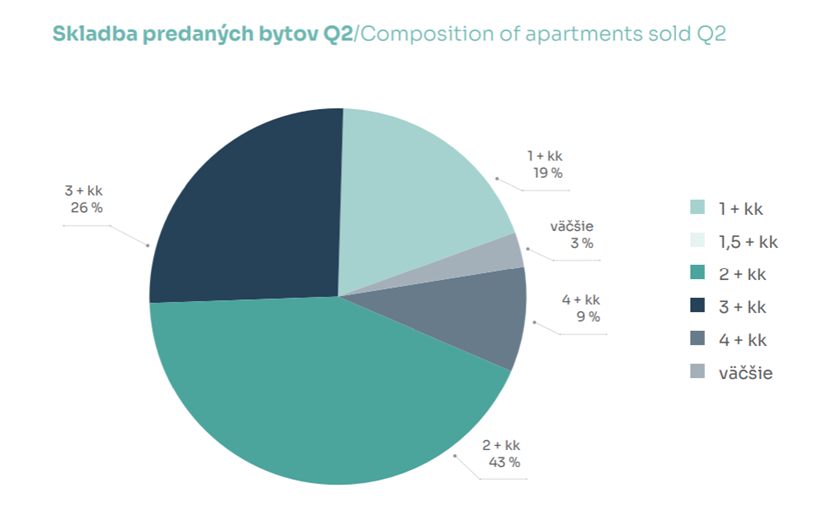

Year-on-year, there has been a 72% decrease in the number of apartments sold. Quarter-on-quarter sales have increased by 21%, with a total of 229 new-build apartments sold in Q2 2023. The most popular alternatives are 2 and 3 room apartments, accounting for two thirds of sales. The focus on owner-occupier housing has been lagging behind investment housing, which is reflected in the proportion of sold 4 and 1 room apartments.

Price of new apartments has increased year-on-year

In 28 new-build projects, out of the total number of 90, prices have been adjusted either due to selling out of smaller apartments, which are more expensive per m², or due to a targeted downward price adjustment. Targeted discounts of more than 200 EUR/m² excl. VAT were seen primarily in projects that need to fully sell the completed offer, or, conversely, following a failed pre-sale or a long-stalled sale, to kickstart demand. The biggest discount recorded was 526 EUR/ m² excl. VAT on average for the entire project. The total average price is 3967 EUR/m² excl. VAT, representing year-on-year growth of more than 4%.